Before making that investment and selecting the ideal diamond, it's critical to comprehend the qualities of a diamond. Why should purchasing a diamond differ from buying a home without first learning about its dimensions and number of bedrooms? Similarly, you wouldn't likely purchase a car without first learning about its color.

Before deciding to buy your lab made diamonds or jewelry, take the following into account. If you're interested in learning more about lab made diamonds, read the information below or get in touch to talk.

What is Lab made Diamonds?

Two processes are used to create lab made diamonds, which are produced by humans in a laboratory setting. High-pressure, high-temperature processes are combined with chemical vapor deposition or HPHT. To summarise, in HPHT, carbon atoms are placed in a tiny capsule that is then sealed in a high-pressure press. Using extremely high temperatures and pressure, it then takes about 4 weeks for the diamond crystals to form. We will go into greater detail at a later time.

In CVD, diamond wafers, also known as seeds, are placed in a vacuum chamber. Methane and hydrogen are then forced into the sealed container, which causes a reaction that releases pure carbon. The carbon attaches to the seeds and forms a bond over about 4 weeks, during which the diamond crystal grows.

In both situations, the best lab grown diamonds are given to diamond cutters who polish them into different shapes and get them ready to be submitted to labs that certify lab made diamonds. IGI and GIA are currently the market leaders in this sector. To hasten the growth process, some manufacturers of lab made diamonds produce stones of lower quality, which may be brown or have more flaws. These synthetic diamonds are then treated to improve the growth result, making the stone appear better than it is.

Oval Lab Diamond for Engagement Ring, 3.30 CT F/VS2IGI Certified Loose Diamond

These fall under the category of "dirty lab grown," which are less expensive and of lower quality than lab made stones. In terms of chemical composition, reflective rate, color diffusion, hardness, thermal conductivity & expansion, transparency, resistivity, and compressibility, lab made diamonds and natural diamonds are identical to one another.

More details will soon be available online in a special section, but feel free to contact us to talk further now. We have an extensive stock of both Natural and Lab Grown diamonds for you to view on our site.

Which factors influenced investing in natural diamonds or lab made diamonds?

The resale value, maintenance costs, a major player in the industry, and government policy on international trade are deciding factors when deciding whether to invest in naturally occurring or lab made diamonds. Investors have always thought about profiting more and more from investments with anticipated ratios.

Natural and lab made diamonds share the same properties and characteristics, so there is no difference between them. However, the location of those two types of diamonds' origins became a deciding factor for price and investment. Examine the differences in resale value between natural and lab made diamonds to help guide your investment choices.

Natural diamonds and lab made diamonds' resale values

Natural Diamonds

You can now more clearly see why natural diamonds are currently the best option for investment after viewing the production process and resale value of both natural and lab made diamonds. But keep in mind that investing in natural diamonds requires more money.

One source of instability is the sudden rejection of deals by nations due to conflict, war, and pandemics. Thus, you risk losing the anticipated return and having your capital trapped in the natural diamond rejection net. Here, I'm not referring to the legend but to the truth, which is revealed below.

Russia began an invasion of Ukraine's surface on February 24, 2022. The USA then imposed a ban on Alrosa as a result of Russia's natural diamond mine. As a result, major diamond consumers like the USA and the UK refused to accept natural diamonds exported from Russia.

The USA's decision to outlaw Alrosa Mine Diamonds, which controlled 30% of the global market for natural diamonds, shocked manufacturers and traders of natural diamonds around the world. Since investors anticipate sizable returns on their investments, you as a diamond investor experienced anxiety as well. But in this case, your expectations were inverted. What ought you to do?

As a result, the producers of natural diamonds have yet to forward their business for specific times. Workers are directly impacted by this factor, resulting in job loss. Investing in natural diamonds would expose investors to this kind of instability. But it's not usual, and I never advise against investing in diamonds that have been mined. By reading the articles featuring interviews with diamond manufacturers, you must assimilate information and make predictions about the diamond industry.

Lab grown diamonds aka Synthetic Diamonds

Yes, Synthetic diamonds are valuable gemstones that are completely identical to natural diamonds and can be extremely expensive; however, their value isn't quite as high. A diamond is a significant investment, whether it is created in a lab or naturally, but an artificial diamond will give you more diamonds for your money. A synthetic diamond will typically cost thousands of dollars, but it will likely cost 60% to 80% less than a natural diamond of the same size and quality.

Round Brilliant Cut Lab Created Diamond for Engagement Ring, 0.90 CT Lab Grown Loose Diamond

Natural diamonds are more expensive to mine than synthetic diamonds, and unlike natural diamonds, synthetic diamonds are a renewable resource. As a result, synthetic diamonds are less expensive to purchase than natural diamonds. A synthetic diamond is still 100 percent real and identical to a brilliant, stunning mined diamond, so it has value because it is a valuable, sought-after, and still incredibly rare product. Additionally, it takes a lot of expertise, time, and equipment to create a lab diamond; as a result, lab diamonds have a significant market value, albeit one that is lower than that of natural diamonds.

It's a common belief that artificial diamonds retain or even increase in value over time. The fact is that when you decide to sell a diamond, neither a natural diamond nor a synthetic diamond will bring in the same amount of money.

When you buy a diamond ring, you are also shelling out money for the jeweler's fair profit and their expertise in grading, cutting, and polishing the stone. The resale value of a synthetic diamond ring will be between 30% and 40% less than what you paid, and the same is true of a natural diamond ring, so be careful not to view this purchase as an investment. Instead, you're spending your money on something priceless that will give you enduring joy.

Because of this, buying them anywhere—including online—is simple. The recommendations provided below act as general guidelines and, if desired, diamond investment tips and tricks.

How do you formulate a suitable diamond investment plan?

The fundamentals (at least)

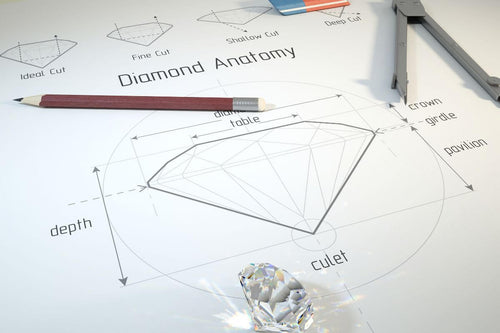

It is best to begin at the beginning. Learn the diamond language and the fundamentals. It should be The 4 Cs of Diamonds first.

Plan a budget

Do not forget that this belongs in your portfolio. Bonds indeed require a larger initial investment than stocks, but this is no justification for going over your budget or the percentage of your portfolio that you had in mind.

Gain a variety of diamonds

Don't risk losing all of your eggs by doing so. We can't all be Warren Buffett, even though he famously said, "Diversification is protection against ignorance, it makes little sense for those who know what they're doing."

When investing in diamonds, diversifying your "portfolio" is a good idea, just like with other investments. If you had set a budget of $20,000 for diamond investments, you might want to consider splitting it into three purchases of $10,000 diamonds.

Compare Prices

Given the abundance of online merchants, comparing asking prices for comparable diamonds is simple (this is harder to do when it comes to colored diamonds where each diamond is different).

Don't be tentative

Ask lots of inquiries. Attempt to speak with diamond consultants and experts. Consult diamond forums. This is a sharing and carrying era. Many people on social networks are eager to help. Some may have already made diamond investments and can share their personal experiences.

Which should I invest in, natural diamonds or lab-grown diamonds?

There is some element of speculation in every investment. All you can do is make an informed decision based on all the available information. Natural diamonds are the obvious choice as the answer. For the time being, you should put your money into natural diamonds. Because the price of natural diamonds is fixed, as you can see above. But even after depreciation, it still covers your investment costs. You can therefore choose to invest in natural diamonds.

If we try to draw any conclusions from what has been written above, it should come as no surprise that investing in diamonds has both advantages and disadvantages. We are convinced that their potential and upside easily outweigh any drawbacks. Simply be conscious of the drawbacks and use them prudently to reduce the risks involved.